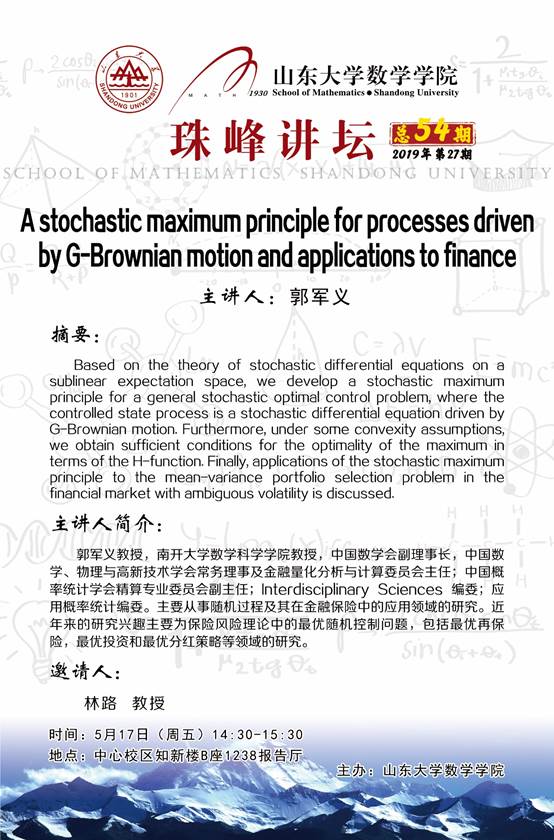

A stochastic maximum principle for processes driven by G-Brownian motion and applications to finance

The speaker:Guo Junyi

Abstract:

Based on the theory of stochastic differential equations on a sublinear expectation space, we develop a stochastic maximum principle for a general stochastic optimal control problem, where the controlled state process is a stochastic differential equation driven by G-Brownian motion. Furthermore, under some convexity assumptions we obtain sufficient conditions for the optimality of the maximum in terms of the H-function. Finally, applications of the stochastic maximum principle to the mean-variance portfolio selection problem in the financial market with ambiguous volatility is discussed.

Introduction to the speaker:

Professor Guo Junyi, professor of school of mathematical science, Nankai University, vice chairman of Chinese mathematics society, executive director of Chinese mathematics, physics and high and new technology society and director of financial quantitative analysis and calculation committee; Vice director of actuarial science committee of Chinese probability and statistics society; Editorial board of Interdisciplinary Science; Editorial board of applied probability and statistics. Mainly engaged in the study of stochastic process and its application in the field of financial insurance. In recent years, his research interests mainly focus on optimal stochastic control in insurance risk theory, including optimal reinsurance, optimal investment and optimal dividend distribution strategy.

Inviter:

Professor Lin Lu

Time: 14:30-15:30, May 17th (Friday)

Venue: lecture hall 1238, building B, zhixin building, central campus

Sponsor: school of mathematics, Shandong University

(Editor in Charge: Lei Hao)